ny paid family leave tax deduction

2022 Paid Family Leave Payroll Deduction Calculator. The state of New York has implemented a Paid Family Leave program funded by the collection of taxes from the employee.

The New York State Department of Financial Services has announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be.

. Paid Family Leave Benefits available to employees as of January 1 2018 may be financed by deductions from wages under a formula set by the New York State Superintendent. 2021 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld. Refund of or credit for prior year state and local income taxes you actually received in 2021. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

Now after further review the New York Department of Taxation and. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. New York Paid Family Leave is insurance.

The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a. The contribution remains at just over half of one percent of an employees gross. Use the calculator below to view an estimate of your deduction.

In 2021 these deductions are capped at the annual maximum of 38534. Deductions for the period of time I was covered by this waiver and this period of time counts towards my eligibility for paid family leave. See PaidFamilyLeavenygovCOVID19 for full details.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. For 2022 the weekly taxable wage base for the family-leave insurance tax is to be the lesser of the employees gross wages for the week or 145017. New York Paid Family Leave Insurance rate.

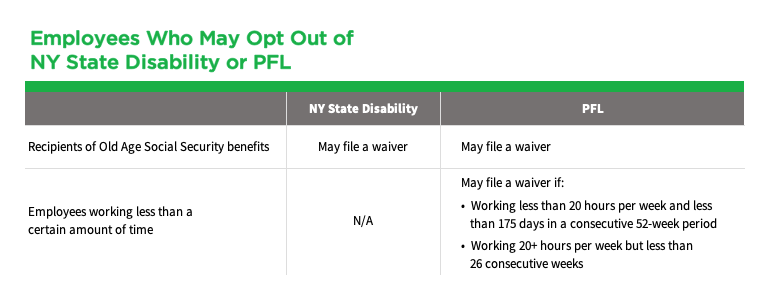

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross. Deduction and Waiver - DB and PFL An employer is allowed but not required to collect contributions from its employees to offset the cost of providing disability and Paid Family. Employees pay for these benefits through a small payroll deduction which is a percentage of their wages up to a cap set annually.

New York State Paid Family Leave. Your premium contributions will be reported to you by your employer on Form. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period.

New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. N-17-12 New York States New Paid Family Leave Program. Paid Family Leave provides eligible employees job-protected paid time off to.

Employers may collect the cost of Paid Family Leave through payroll deductions. Employers have the option to pay on behalf of their. Are the premiums paid under the Paid Family Leave program through employee payroll deduction considered remuneration for unemployment insurance purposes.

The maximum total contribution for. Payroll Deduction for NYs Paid Family Leave Starting July 1st. New York made headlines last year when it announced the passage of the nations strongest family leave.

I certify to the best of my knowledge the foregoing. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period.

New York Paid Family Leave Resource Guide

The Next Big Question On New York Paid Family Leave How Do We Determine Tax Obligations

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Get Ready For New York Paid Family Leave In 2021 Sequoia

Nys Paid Sick Leave Vs Nys Paid Family Leave

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

Get Ready For New York Paid Family Leave In 2020 Sequoia

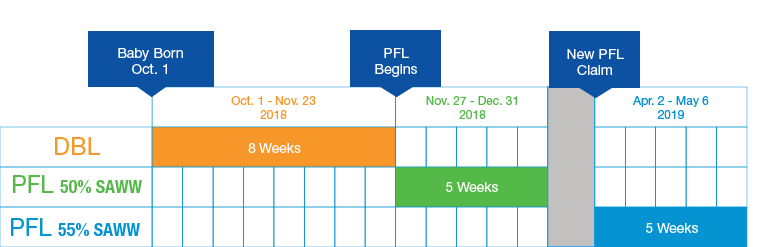

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

New York Paid Family Leave Resource Guide

New York Paid Family Leave What You Need To Know For 2019

New York State Paid Family Leave Cornell University Division Of Human Resources