child tax credit 2022 update

From December 2021 to. Science Has Better Ways to Treat Anxiety.

Stimulus Update Here S Why Some Families Will Receive 3 600 Child Tax Credit Payment In 2022 Silive Com

Every year the IRS updates CTC which stands for Child Tax Credit to update the requirements and tax credits.

. Eligible taxpayers in Connecticut have until July 31 to claim the cash. Child Tax Credit update. The amount you will receive depends on your income and filing status but the credits.

Eligibility Requirements To Get 1800 or More. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Forget Weed Wine and Xanax.

0 2 minutes read. Child Tax Credit deadline looms for millions. By Madz Dizon Feb 01 2022 0824 PM EST.

In 2023 the maximum child tax credit will be 2000 per child. The Child Tax Credit Update Portal is no longer available. January 10 2022.

However if you want to see the money sooner you can file your 2022. Additional New York State child and earned income tax payments. Child Tax Credit Changes.

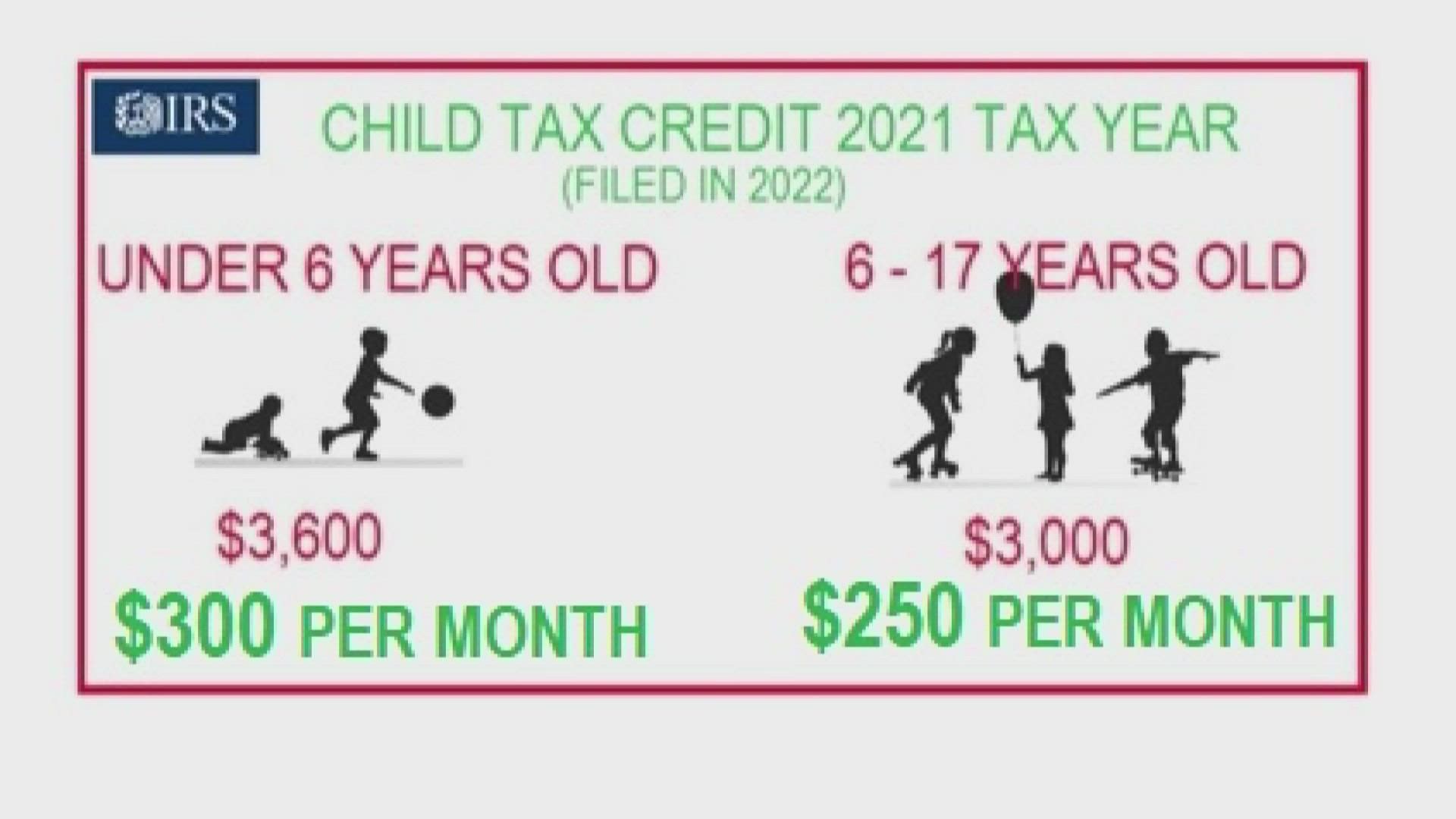

Colorado is rolling out a new child tax credit in 2022 that is similar to the federal support. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. Citizens may be eligible for up to 3200 in direct checks according to the Government.

Enhanced child tax credit. The percentage and the child care expense thresholds changed so you can get a credit up to 50 of 8000 4000 in child care expenses for one child under 13 an. However it will only be available in the form of a tax refund.

IRS Tax Tip 2022-33 March 2 2022. The 20222023 New York State budget provides for one-time checks to eligible taxpayers for two separate payments. 1200 sent in April 2020.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child. When November 2022 Benefits Will Be Sent. Through the child tax credit or COVID-19 relief stimulus checks low-income US.

The child tax credit was expanded from 2000 per child to 3000 per child for children over the age of. In 2022 the tax credit could be refundable up to 1500 a rise from. Social Security Schedule.

As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. Child Tax Credit 2022 Update. Long before the expanded child tax credit was.

However Republican Senators Mitt Romney Richard Burr and Steve Daines. Josie Carson Last Updated. Stimulus check update.

Taxpayers may claim the credit for each qualifying child under the age of 18 with a Social Security number. Senators hold out hope on survival of child tax credit. Governor Ned Lamont signed the 2022-2023 budget bill in June which included a child tax rebate.

New 2022 program worth 4000 per child available after CTC payments end. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

White House Unveils Updated Child Tax Credit Portal For Eligible Families

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

State Officials To Provide Update On State Child Tax Rebate

Child Tax Credit July 2022 Who Will Receive This Payment Child Credit Updates Youtube

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

Update On The Child Tax Credit Letters From The Irs February 2022 Youtube

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

Increased Child Tax Credit Public Hearings Schedule Multiple Sclerosis Awareness Month Connecticut House Democrats

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Parents Can Still Claim Their Expanded Child Tax Credit By Nov 15 2022 Here S How

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Child Tax Credit Payments Are Done How To Get Yours Wfmynews2 Com